Last week I likened our current national fiscal/monetary challenge to blacksmithing. While most of us fixate on the unmoving arm of the legislative branch, few pay much attention to the seemingly insolvable: the anvil of our national debt.

That anvil is heavy, ugly, and immobile. But it may not be as it appears! Without the anvil, there would be no singing, no poetry of motion, no useful implement created. How could that debt be useful?

Like a ship’s captain, the Federal Reserve is attempting to steer the economy between the sandbars of inflation and unemployment. Without the extraordinary intervention and coordination of actions by the Fed and other Central Banks, the worldwide economy might well have totally collapsed in 2008.

Like a ship’s captain, the Federal Reserve is attempting to steer the economy between the sandbars of inflation and unemployment. Without the extraordinary intervention and coordination of actions by the Fed and other Central Banks, the worldwide economy might well have totally collapsed in 2008.

Since the Great Recession, the Fed has continued to sustain a low-interest environment in an attempt to increase liquidity and grow the economy. Since the Fed cannot lower the interest rates any further, it has adopted a number of extraordinary measures including Quantitative Easing (QE).1 Currently, the Fed uses QE to increase the money supply by $85B per month, buying treasuries from banks and thereby increasing money reserves for banks. That additional liquidity is intended to increase loans to small businesses and consumers to stimulate investment and consumption. This added demand could, theoretically, lead to job creation. And it has increased the size of our debt anvil.

Yet if Modern Monetary Theory (MMT) is correct, the size of that anvil may not seem as bad as it appears.

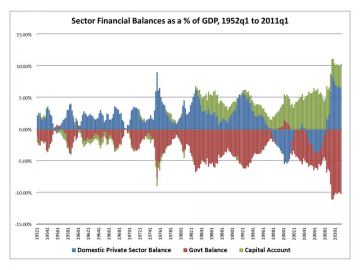

Households, municipalities, and even states must, at the end of the day, balance their budgets. However, countries like the U.S. who issue their own currency—fiat currency—are not bound by the same rules. When the federal government runs a deficit, it has spent more than it has collected in taxes. The private sector is thus the (theoretical) beneficiary of that spending.

On the other hand, if the federal government runs a surplus, it has spent less than it has collected in taxes. It has, in effect, taken wealth from the system.

That is the essential story behind the chart below: MMT would argue that the debt of a fiat currency cannot ever not be honored. The country can, in essence, hollow out that anvil of debt through the judicious use of keystrokes/QE.

http://www.levyinstitute.org/multipliereffect/wp-content/uploads/2011/11/US-Sectoral-Balances_Berlin.png

For an in-depth discussion, see this post on the Levy Institute’s blog.

Just as a blacksmith without an anvil cannot hammer a glowing piece of steel into a horseshoe or a wagon wheel rim, so too our economy cannot continue to grow GDP—create the horseshoe—without the debt. National debt, MMT argues, is not inherently evil, but represents the aggregate commitment of a nation to be able to service that debt. The tale of the chart above says “it works:” nations that create fiat debt can also create the liquidity to service that debt and, in fact, enable the economy to grow.

Over the next few weeks, we will walk through the liminal dimensions of national debt. What is it?

1Some members of the Fed are concerned that QE may have the unintended consequence of creating instability by pushing both banks and investors toward riskier asset classes like junk bonds.

Toolkit:

Share your thoughts:

How much are you concerned about the federal deficit? Your clients?

In what specific ways does that concern shape your tax and planning strategies with clients?