Jerry Paul, ICON bond fund manager, would say you might be! As a result of traveling the country and talking with hundreds of broker dealers and financial planners in the fall of 2013, Paul found that they were running a terrific fever: they had caught the hysteria fever that there would be an imminent skyrocketing of 10-year Treasury rates.

His prescription? Base your beliefs and recommendations on the facts! Paul presented his case for a continuing low-interest rate environment at this month’s Colorado FPA (COFPA) chapter meeting.

Paul noticed that people tended to get swept up into the hysteria generated by well-known financial talking heads. Whether you agree or disagree with Paul’s case, it’s important that we are able to articulate our own position on this and other key financial issues both for our own sake and for the sake of our clients. As we do this, are we willing to consider other viewpoints or are we getting intellectually lazy and falling into confirmation bias—the tendency to listen only to those opinions that reinforce our own? (A few other biases that we could fall into/need to guard against include anchoring, groupthink, and belief perseverance).

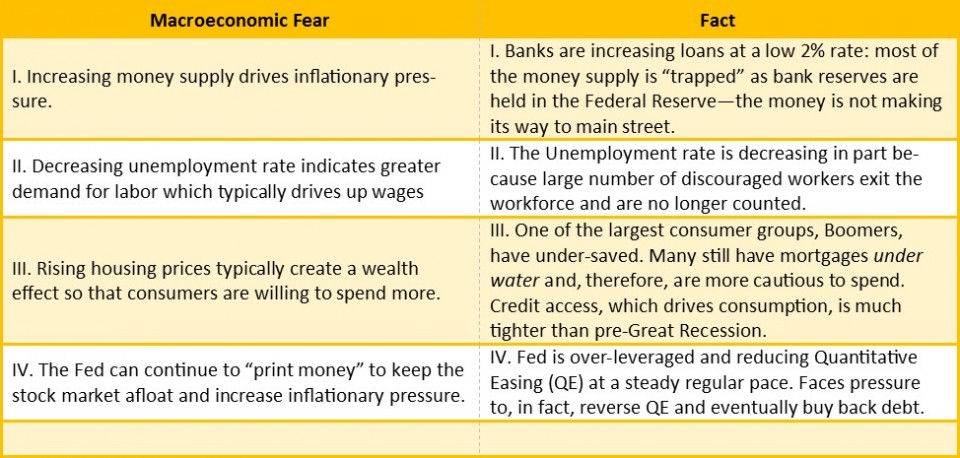

Paul built his case around the following macroeconomic fears and corresponding facts:

Given this case, Paul recommended several potential actions we and our clients might take:

- Reduce debt

- Increase retirement savings rate 6-9% per year

- Extend our working careers 3 to 5 years

All of these are powerful, basic actions our clients might take to act on the facts of the current low-interest rate environment.

Do you still have a fever? Given this knowledge, how might this impact your personal decisions and professional advice?

Toolkit:

Developing your own assumptions about interest rates will shape the frame of your picture as a financial advisor or business owner. Here are a few areas your assumptions could impact:

- Assessment of the potential purchase of your building and/or investing in rental properties.

- Allocations within the fixed income portion of portfolios.

- Exposure to emerging market debt.

- Assessment of the risk/return profile of high-yield bond funds.