At a recent Colorado Financial Planners Association (COFPA) meeting, Sameer Somal, Blue Ocean founder, gave a sobering snapshot of things every financial advisor needs to consider: what’s next for your practice. When an industry like financial planning is undergoing rapid tectonic plate shifts, the impact of those shifts create a tsunami of change to every participant in the industry—not only advisors–especially their clients.

I rarely use superlatives like “every” but consider the following profile of the financial advisory space:

- Average age of a financial advisor is 50+

- 10% are 60 and older

- Of the advisors within two years of retirement age more than half do not have a written succession or contingency plan

- 75% of advisors have never had a third party valuation of their firm

- More than 40% of approximately 315,000 advisors will transition their practices over the next 15 years.

Where are their successors coming from? One of the most sobering statistics is that:

- only 5.6% of planners are under age 30.

The majority of you face an industry-wide challenge: there are few strong candidates to take over your practice. Since only 5.6% of planners are under the age of 30, the average planner faces stiff competition in finding their successors.

Why are there so few planners coming into the industry?

According to Pershing CEO, Mark Tibergien, older advisors are often the problem. We are burning out our younger colleagues with poor management and mentoring, prompting these younger advisors to either look elsewhere or leave the advisory business completely. These advisors, in turn, Yelp their dissatisfaction to 1000s of social media followers, magnifying our challenge.

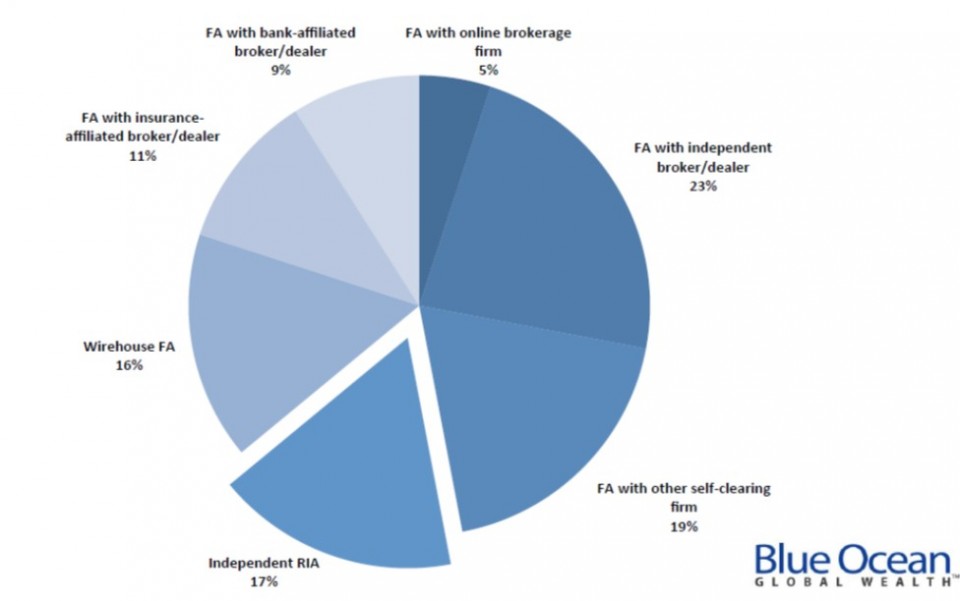

Adding to the complexity of finding successors, consider that financial advisors live in a fragmented, dynamic industry. Insurance, banking and wirehouses are just a few of the origins of our planning practices:

IMAGE: NPP Advisors Services Group. “The Efficient Frontier of Succession: Maximizing Practice Value”. May 2012.

Planning on a seafloor of shifting tectonic plates makes deciding where you want to land difficult.

We, in the financial planning world, face difficult choices.

Consider this: to decide is empowering.

To decide is to give yourself future options. Would you rather be able to give yourself and your clients choices like:

- Sell your practice to a like-minded advisor or peer.

- Sell your practice to financial institution.

- Create a path for internal succession.

- Partner with a succession firm.

- Take a hybrid (semi-retired) role.

- Turn out the lights.

Or, would you rather not decide and be faced with only one option: the demise of your business due to

- Disability

- Death.

What choice will you make this week? See the Toolkit below for some ideas.

Next week’s topic: identify and address the internal challenges when setting up your succession plan.

Toolkit:

What are some initial steps you might take as a planner?

- Consider ways to begin “giving back” to younger planners. Or, if you’re a younger planner, consider potential mentors to approach. The COFPA has provided a forum where such an exchange can take place: Veterans and Rising Stars. Click here for the Mar. 19 event and other opportunities.

- Explore ways you can develop junior members of your firm. Or, if you’re a junior member, develop your own “independent study” plan and propose it to your supervisor.

- Decide to give yourself a choice. Take an initial step toward creating a written plan by setting time in your schedule this week to get started. Set measureable waypoints to ensure steady progress toward completion.