John Gabriel, Regional Manager at Weitz Investment Management, gave an insightful talk on active shares for professional investment advisors at a recent gathering of the Colorado FPA . Let’s see how his talk framed a doorway to what every business owner (especially financial planners) ought to strive for.

Let’s begin with describing the doorway itself:

What are Active Shares?

ETFs and indexed mutual funds are designed to be as low-cost as possible. They are shopping carts of companies designed to match benchmarks like the S&P500.

Some funds are designed so they leverage the stock-picking wisdom of the analysts. What I found surprising is how large a percent of current fund managers—even those that claim to be active stock pickers—are in fact “closet” indexers who are hugging a benchmark. Matching those benchmarks is one of the surest ways to not get fired but a strategy that could constrain your potential returns.

According to a study by Yale professors, “active” fund managers–those who deviate from the industry benchmarks—significantly outperform their indices after fees (Cremers & Petajisto).

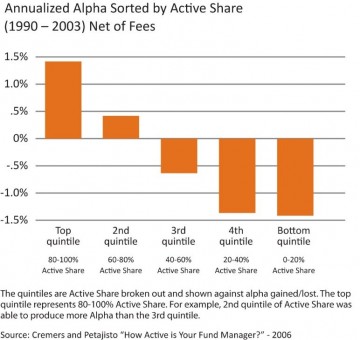

The graph below summarizes Cremers and Petajisto’s story. By examining fund managers’ performance over 1990-2003, they found that if a portfolio was 80-100% active share—significantly different from the benchmark—it had the largest positive deviant return of almost +1.5%. On the other hand, even if up to 40% of the portfolio was different from the benchmark, those portfolios yielded a negative Alpha of almost -1.5%. Sticking too closely to an index benchmark put an outsized drag on performance.

http://www.milliondollarjourney.com/wp-content/uploads/edrempelactiveinvestor1.jpg

The moral of their story: if you’re going to be a stock picker, do so with conviction!

All fund managers, no matter how good, will, at some point, be in the bottom 20% of all managers. Spending a long time in the bottom quintile is a sure way to see more sales than purchases of one’s fund.

It often takes years before an active manager’s investment thesis yields the above average returns story of +1.5% higher returns. This story is not for the impatient investor or faint-of-heart manager.

On the other hand, if you ever hope to achieve above-average returns, you’d need to include some Active Shares funds in your portfolio. And you should see if you have too many “closet index” fund managers who will drag down your portfolio performance.

Wally Weitz, founder of Weitz Investments, looks for long term investments. When kicking the tires on a potential company to add to his fund, he will ask the business owners and managers of those firms what they’d do differently if they knew they had time to execute. Wally’s looking for long term outsized returns, not a quick hit.

How does this doorway of “Active Shares” relate to your business and your life?

Like the successful fund manager who has hundreds of billions in his fund, the business owner who’s achieved a measure of success is sorely tempted to be conservative, retrench, and hunker down. S/he’s tempted to hug her own version of a benchmark.

Yet for business owners, Active Shares–your utter convictions about your firm–are what brought you and your firm its current success. So you need to ask yourself Weitz Investment founder Wally’s question:

“If it’s just us in a room and we [CEO and Weitz] own the whole company, what would you do differently?”

If you’re thinking about selling your firm someday, remember that every prospective buyer wants a business that has both sizzle and steak.

What are you doing to keep the “sizzle” going? The buyer knows you’re selling steak. This metric of active shares for assessing mutual funds is a surprising doorway to something we intuitively know: why every firm should strives to stand apart from the crowd of conventional wisdom.

Do you want your business to be average by hugging your benchmark? Or are you willing to tell and expand upon your firm’s story with conviction, clarity and commitment?

Toolkit:

What story is your firm telling the marketplace today? What do you need to do to tell your unique story of your vision, your firm’s mission and its core values?